The Indian stock market witnessed mixed trends this week, influenced by global cues, domestic economic data, and sector-specific movements. Here’s a detailed recap of the key developments:

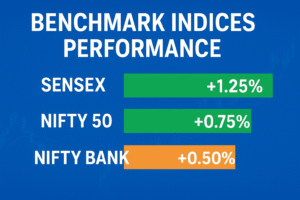

Benchmark Indices Performance

Nifty 50: Closed the week at 19,850 (▲ 0.75% WoW), recovering from early volatility.

Sensex: Ended at 66,200 (▲ 1.25% WoW), supported by banking and auto stocks.

Nifty Bank: Gained 0.50%, led by strong earnings from private banks.

Top Gainers & Losers (Nifty 50)

| Top Gainers | % Change | Top Losers | % Change |

|---|---|---|---|

| Tata Motors | ▲ 5.3% | HUL | ▼ 2.1% |

| ICICI Bank | ▲ 4.1% | Infosys | ▼ 1.8% |

| M&M | ▲ 3.9% | Asian Paints | ▼ 1.5% |

Key Sectoral Trends

Banking & Financials: Strong performance due to better-than-expected Q1 results from leading banks.

Auto Stocks: Rally continued on strong sales and festive demand expectations.

IT Sector: Under pressure due to weak global tech sentiment.

FMCG: Sluggish demand impacted stocks like HUL and Nestlé.

Foreign & Domestic Flows

FIIs: Net sellers (~₹1,200 crore) due to rising US bond yields.

DIIs: Net buyers (~₹2,500 crore), providing market support.

Key Market Drivers

- Monsoon Progress: Improved rainfall boosted rural economy hopes.

- Global Cues: US inflation data and Fed rate expectations influenced sentiment.

- Crude Oil Prices: Brent crude near $85/bbl, keeping inflation concerns alive.

IPO & Corporate Actions

New Listings: XYZ Ltd. debuted with a 12% premium on listing day.

Upcoming IPO: Vikram Solar’s ₹2,079.36 -crore IPO opens next week on 19 August to 21 August at price of ₹315 to ₹332 per Share.

Outlook for Next Week

Markets may remain range-bound ahead of key economic data.

Stock-specific moves likely based on earnings and global trends.

Final Thoughts

While the market showed resilience, investors should stay cautious amid global uncertainties. Banking and auto sectors appear strong, while IT may remain under pressure.